Each month your bank will send you a record of your income and expenses. You can use that bank statement to reconcile your transactions to make sure they match up with your own accounting system, invoices, payments, etc. If your construction business follows generally accepted accounting principles, you should use the percentage of completion method for financial statements as well. Each business needs to have a general ledger and records of accounts payable and receivable. General accounting requires people to use Generally Accepted Accounting Principles (GAAP), as does construction accounting.

For example, https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects knowing the exact cost of materials and labor helps in quoting accurate project estimates. Reliable financial data also simplifies tax preparation and compliance, reducing the risk of audits or penalties. Maintaining precise books allows contractors to secure loans or lines of credit more easily, as lenders require transparent financial documentation. QuickBooks is one of the most popular accounting software options for a variety of businesses.

Develop an easy-to-follow system and create a habit of recording each transaction at the end of each workday. The construction industry is highly susceptible to political and economic fluctuations that disrupt the supply chain. Things can happen beyond your control to destabilize your cash flow, such as bad weather conditions or a piece of equipment breaking down. If you don’t have a highly accurate and efficient construction bookkeeping system, the rest of your business will suffer. This guide to construction bookkeeping construction bookkeeping will give you the best practices when managing your books and performing accounting tasks.

If you don’t intend to hire a professional, follow these best practices for construction bookkeeping to keep your financial records updated. Construction has a unique type of payment structure that includes retainage, Retainage is the amount of money that clients withhold until they are satisfied with a project. When you have multiple projects going on, you need reliable and strong retainage management to ensure you have capital in case the client withholds the money. Obviously, this cannot be accomplished without strong bookkeeping practices.

The Advanced plan adds business analytics with Excel, the ability to manage employee expenses and the ability to batch invoices and expenses. The Advanced plan also has task automation, reducing the amount of time you spend on data entry. Get a dedicated account team to help you with problems and provide on-demand online training. While in the preconstruction phase of a project, you can perform prequalification of clients, do bid management and create comprehensive estimating. When in the project management segment, you can incorporate quality and safety standards, have design coordination and oversee the entire project. Resource management solutions include a labor chart and field productivity data.

You can connect with a licensed CPA or EA who can file your business tax returns. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice.

Bookkeeping for construction companies helps you accurately track your income and expenses, so you can easily make adjustments when needed and better manage your projects. Without good bookkeeping, you risk going over budget on projects and not having the cash flow to cover your expenses. Quickbooks is a good, solid accounting system for most construction businesses when they are starting out. If you are using WIP reporting, start your spreadsheet early so you don’t have to go back and recreate it later. And take some time to learn workarounds for retention and certified payroll if you need them.

Planning for growth and expansion is essential for general contractors looking to scale their business. This involves creating a budget, forecasting future revenue and expenses, and identifying investment opportunities. By developing a strategic growth plan, contractors can allocate resources effectively, mitigate risks, and seize new expansion opportunities.

If you’re looking for the perfect middle ground, we recommend FreshBooks accounting software for construction. “We love the ability to work WITH our subs on our project management software instead of it being an in-house only product. There are a LOT of working points and a lot of tiny steps that are required to make certain workflows function properly.

To ensure job costing is accurate, businesses must monitor and track their billing process closely. For this reason, we’ve outlined all the billing basics in contractor accounting. Your company may manage short- and long-term contracts, often with varying end dates. To stay on top of cash flow and keep your books in check, you will need a flexible yet organized construction accounting system. Managing finances as a general contractor can feel like juggling too many balls at once.

Follow this resource step-by-step to establish an effective accounting process, avoid costly mistakes, and make more money. There is a lot of construction software out there for today’s construction firms to choose from. Ideally, a construction software that automates some – or all – of your bookkeeping would make running your business a lot easier.

Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. A Schedule of Values is an essential tool used in construction project accounting that represents a start-to-finish list of work… We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for construction bookkeeping amounts they have not paid us for, is this legal?

You can invoice clients and make payments directly from the app and monitor the budget to make sure you https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ stay on track. The purpose of the Act is to protect local wages from being undercut by out-of-area contractors and construction workers. The Davis-Bacon Act applies to all construction projects under government contracts, including road construction, building construction, renovations, new construction, and painting. This method assumes that a construction company records costs and revenue after they finish the job rather than incrementally throughout the project. Improving your process starts with understanding how construction accounting is unique, and determining the different types of job costs you can incur on each project. However, you can take a “completed contract” approach as well, which involves calculating taxes owed on each contract.

Under the financial management segment, you can make intercompany entries and manage workflows and content management. It allows adjustments to be made easily and can provide month-end and year-end reporting quickly. This is best for contractors who want clients to have access to cost data and project management oversight. We dug into 14 of the top construction accounting software platforms on the market and found these 10 to be the best.

The platform manages the request through the documentation provided by vendors. You’re able to then compare vendors side-by-side to make the most educated decision. Many factors make it challenging for companies to accurately track and report their financial activity. Essentially, this ASU improves disclosure requirements, prompting more useful information out of financial statements. The FASB put it in place to ensure companies provide more transparency into how they recognize their revenues.

Not all standard accounting software has the features you need for the construction industry. For example, suppose your company uses progress billing on large jobs (where each invoice is charged against the total cost of the job over time until the balance is paid). In that case, your construction accounting software needs to be able to produce a schedule of values to help you track the running total. Another key feature to look for is the ability to create Job Cost Reports. FreshBooks allows you to automatically track expenses, easily capture data from receipts, manage financial insights and reports, and keep your construction projects running smoothly. Implementing construction accounting software can transform your business operations in several ways.

近年来,受煤炭行业供给侧结构性改革影响,我国煤炭产量及消费量均出现了先降后升趋势。在经历供给侧结构性改革后,我国煤炭产量及消费量已逐步回暖。煤炭价格震荡上涨,煤炭行业景气指数稳步上行。煤炭行业兼并重组步伐加快,行业集中度不断提高。为了保障安全生产,提高生产效率,煤炭企业对于机械化、自动化、智能化开采系统的应用需求日益增加。

客户:淮南万泰电子股份有限公司

客户行业:智慧电网、智慧矿山、地质信息勘查及预警一体化、矿山环保。

万泰成立于1998年,经过20多年的发展沉淀,现拥有淮南万泰电子股份有限公司、万泰上海分公司、万泰电气有限公司、安徽地球物理技术有限公司、淮南枣晨机电五个分子公司,并且在淮南、合肥、上海、深圳设立四大研发基地。主要致力于智慧电网、智慧矿山、地质信息勘查及预警一体化、矿山环保等业务。

万泰主要致力于智慧电网、智慧矿山、地质信息勘查及预警一体化、矿山环保等业务。围绕全矿井自动化、5G+4G+WIFI6+UWB的矿井融合通信网络建设,永磁电机、永磁电滚筒、变频器的智能传动系统终端设备。

WAGO SCADA源码授权+定制化开发

万泰电子根据自身在智慧矿山的硬件实力和整合系统实施能力,计划打造煤矿智能管控一体化系统解决方案。因此万泰急需一套自主可控,架构稳定,能满足煤矿环境要求的网页组态软件,且具备工具化,扩展性强,部署灵活等特点。万泰电子经过市场考察,产品试用,深度测试,确认WAGO SCADA网页组态软件符合预期,WAGO SCADA源代码级的授权交付和深度定制能力尤其重要,因此决定与万可集团合作,采购WAGO SCADA软件源代码授权以及一部分深度定制服务。

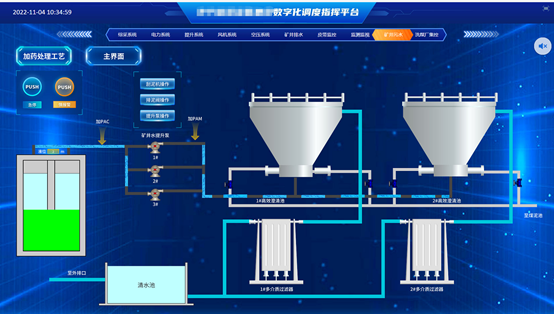

通过源代码授权以及我们提供的技术培训和支持,万泰软件团队不仅掌握了WAGO SCADA软件的使用,也深刻了解了软件的底层架构以及自主拓展新功能的开发。万泰的软件团队根据行业应用进一步做了相关通用功能的开发,历时三个月,万泰就打造出属于自己的新版[智慧矿山数字化调度平台],以WAGO SCADA软件为基础,通过自定义画布、数据源驱动、点位配置和设置实现了如设备数字孪生3D展示等特色功能。